Although Demotech, Inc. has assisted Florida’s residential property insurance marketplace since 1996, FAIR sought to assess Demotech’s contribution to insurer ratings in other jurisdictions. These independent studies and publications, by eminently qualified scholars and professionals including two of our own from Florida State University, provide multiple perspectives and research accumulated over an extended period that FAIR has found to be noteworthy. Please click each study and author for more details.

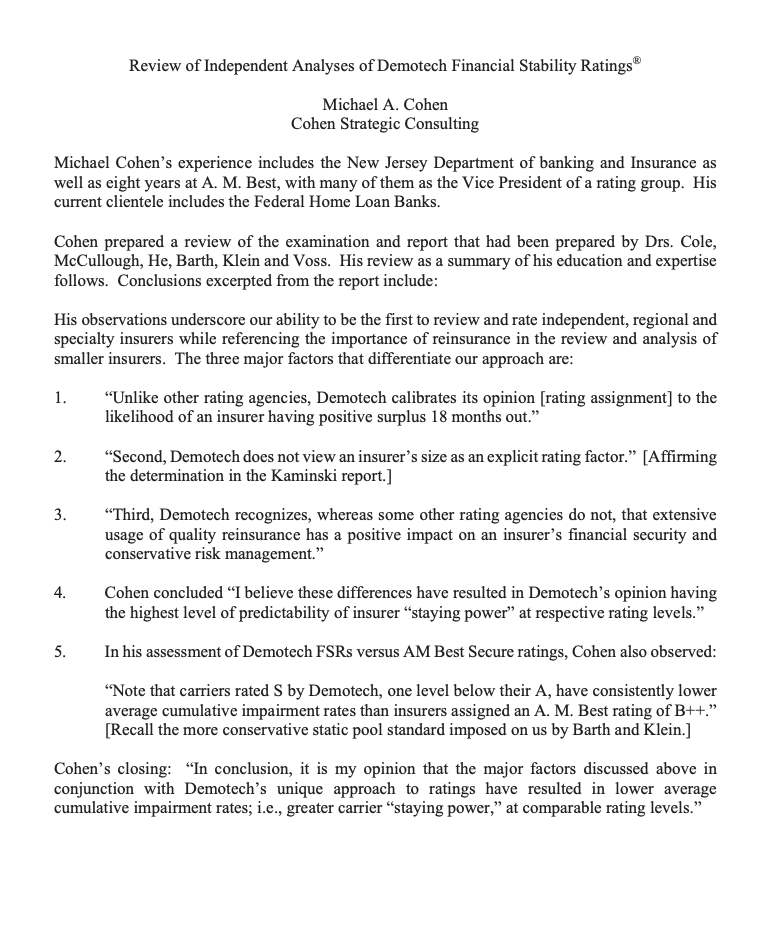

Review of Independent Analyses of Demotech Financial Stability Ratings® (2021)

Michael A. Cohen

About the Author: Michael Cohen is currently the Founder and Principal at Cohen Strategic Consulting where his clients include various insurers and Federal Home Loan Banks. Prior to this work, Cohen spent 8 years as a Vice President at A.M. Best.

Summary of Findings:

Cohen identified three major factors that differentiate the Demotech approach:

1. “Unlike other rating agencies, Demotech calibrates its opinion [rating assignment] to the likelihood of an insurer having positive surplus 18 months out.”

2. “Second, Demotech does not view an insurer’s size as an explicit rating factor.”

3. “Third, Demotech recognizes, whereas some other rating agencies do not, that extensive usage of quality reinsurance has a positive impact on an insurer’s financial security and conservative risk management.”

Cohen concluded “I believe these differences have resulted in Demotech’s opinion having the highest level of predictability of insurer “staying power” at respective rating levels.”

About the Author: Dr. Doug Voss is a Professor of Logistics and Supply Chain Management at the University of Central Arkansas and holds the Scott E. Bennett Arkansas Highway Commission Endowed Chair of Motor Carrier Management.

Summary of Findings:

1. Voss noted “By this measure, as judged by the criteria in Cole et al (2011), Demotech’s rating criteria are most similar to AM Best.”

2. “Equally impressive is that the underwriters [insurers] assigned Demotech’s S rating, which have been calculated and verified by Barth and Klein, are comparable to those underwriters [insurers] assigned an A.M. Best rating of A-.”

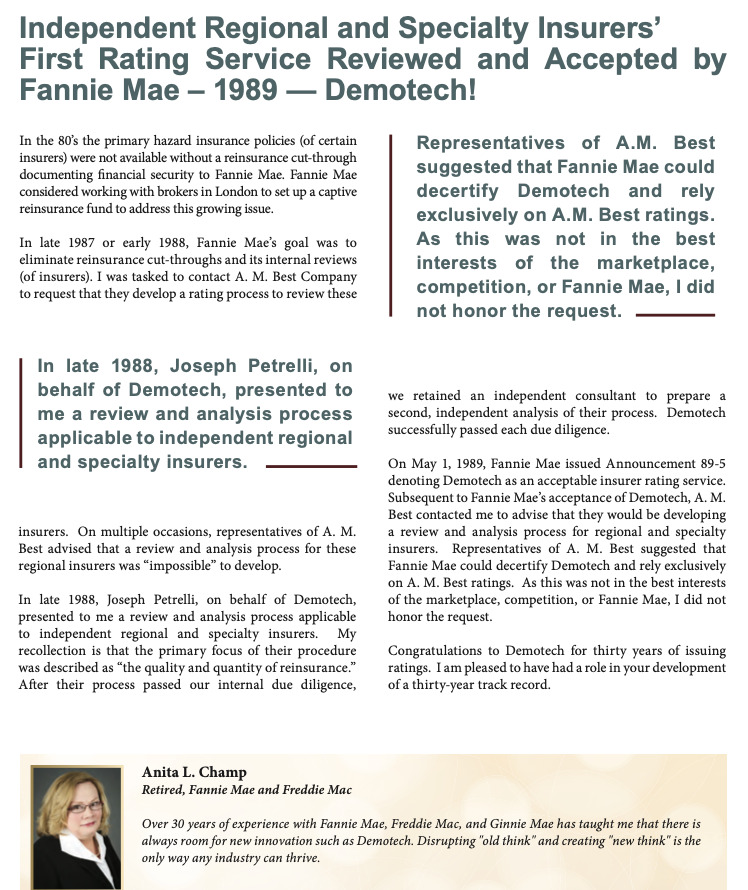

Independent Regional and Specialty Insurers First Rating Service Review and Accepted by Fannie Mae (2019)

Anita Champ

About the Author: Anita Champ is retired with over 30 years of experience at Fannie Mae, Freddie Mac, and Ginnie Mac. During her work, Champ conducted the initial due diligence on Demotech.

Summary:

After both internal and independent analyses of Demotech’s process, Fannie Mae denoted Demotech as an acceptable insurer rating service in 1989, highlighting to Champ that there is “always room for new innovation…disrupting the “old think” and creating “new think” is the only way an industry can thrive.”

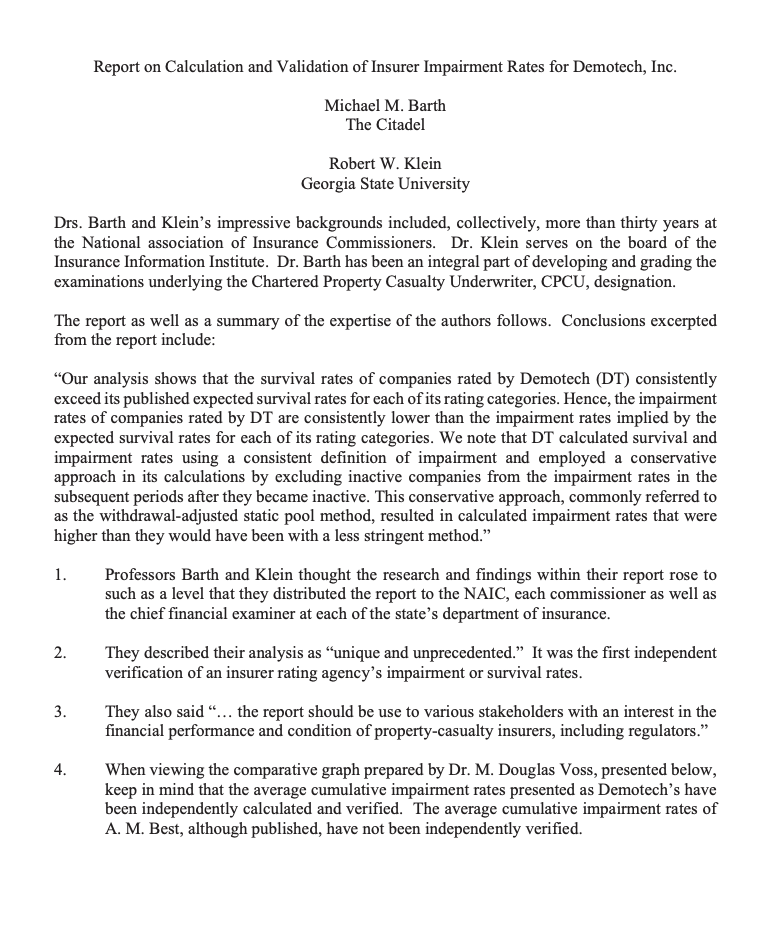

Report of Calculation and Validation of Insurer Impairment Rates for Demotech, Inc. (2018)

Michael M. Barth, Ph.D., Robert W. Klein, Ph.D.

About the Authors: Dr. Michael Barth and Dr. Robert Klein collectively spent more than 30 years at the National Association of Insurance Commissioners (NAIC). Dr. Barth is currently an Associate Professor of Finance at the Citadel. Previously, he was a Senior Research Associate at the NAIC where he developed the initial NAIC risk-based capital formula and was integral in developing and grading the examination underlying the Chartered Property Casualty Underwriter (CPCU), designation. Dr. Klein is an Associate Professor of Risk Management and Insurance and the Director of the Center of Risk Management and Insurance Research at Georgia State University. In addition, Dr. Klein is a Non-Resident Scholar at the Insurance Information Institute and previously served as Chief Economist at the NAIC.

Summary of Findings:

1. Professors Barth and Klein described the research and findings within their report rose to such a level that they distributed the report to the NAIC, each commissioner as well as the chief financial examiner at each of the state’s department of insurance.

2. They described their analysis as “unique and unprecedented.” It was the first independent verification of an insurer rating agency’s impairment or survival rates.

3. They also said “… The report should be used by various stakeholders with an interest in the financial performance and condition of property-casualty insurers, including regulators.”

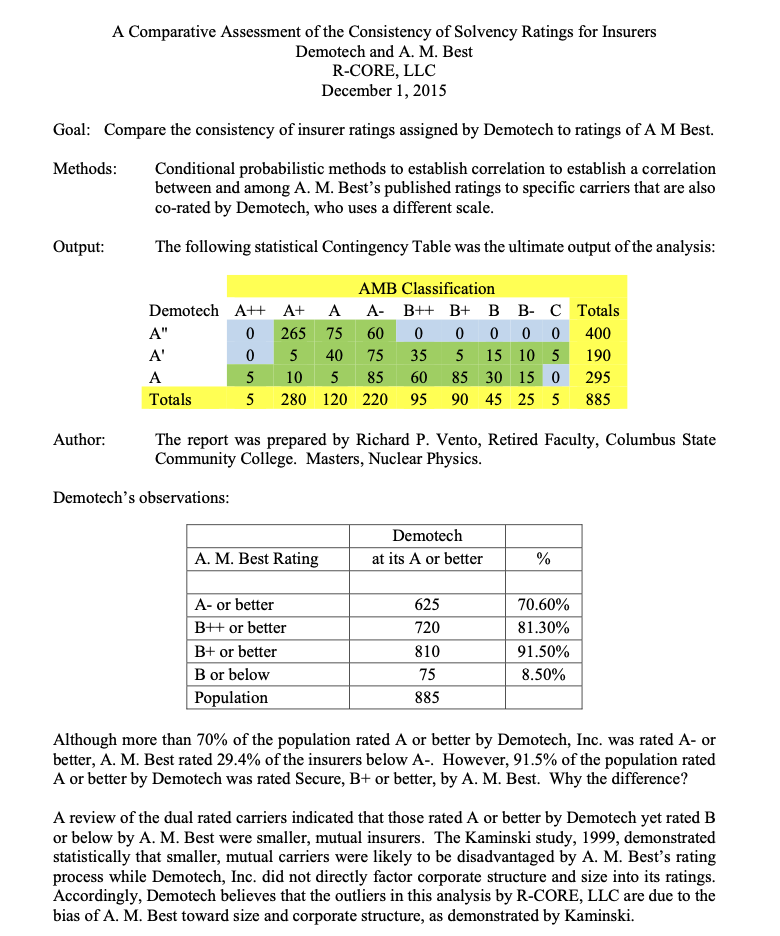

About the Author: This report was prepared by R-Core, LLC and authored by R.P. Vento who is a retired adjunct faculty member at Columbus State Community College.

Summary of Findings:

A review of the dual rated carriers indicated that those rated A or better by Demotech yet rated B or below by A. M. Best were smaller, mutual insurers.

A Comprehensive Examination of Insurer Financial Strength Ratings (2011)

Cassandra R. Cole, Ph.D., Enya He, PhD and FCII, Kathleen A. McCullough, Ph.D.

About the Authors: Dr. Cassandra Cole, Dr. Enya He, and Dr. Kathleen McCullough are considered to be some of the most prolific insurance researchers in the U.S. Dr. Cole is currently the Chair of the Department of Risk Management/Insurance, Real Estate, and Legal Studies at Florida State University. Dr. He is currently the South-Central Regional Director for Lloyd’s America and was a tenured Professor of Insurance at the University of North Texas. Dr. McCullough is currently the Associate Dean for Academic Programs and State Farm Professor in Risk Management at Florida State University.

Summary of Findings:

Conclusions excerpted from the examination or executive summary include:

1. Demotech serves the need of another unique group of insurers, namely those that are geographically focused.

2. Comparisons of Demotech ratings to other agencies show relative consistency in the factors that drive Demotech ratings compared to agencies such as A.M. Best, Moody’s, Standard and Poor’s, and Fitch.

3. There is also general consistency in the firms that each agency would categorize as financially secure

Demotech, Inc., and A.M. Best Ratings Comparison Study (2000)

Mark Kaminski, Ph.D.

About the Author: Dr. Mark Kaminski is a statistical consultant with decades of professional and academic experience, including 11 years as a mathematical statistician at the Bureau of Labor Statistics.

Summary of Findings:

Dr. Kaminski’s statistical analysis of A.M. Best ratings and Demotech ratings demonstrated that A.M. Best ratings are ‘strongly dependent on size as well as corporate structure, i.e., mutual versus stock insurers.

Click here to download all of the above publications, studies, reviews, and backgrounds on the authors.